|

Feb

2018:

Measure A

would raise the parcel tax on single family homes and condos to $1,498

— a

31 percent rise

— effective July 1. The steep increase is to offset the $750,000 loss

in business and commercial property tax revenue caused by a

court-mandated switch from the district’s current parcel

tax, (which uses a per-square-foot tax for business and commercial

property and a flat rate tax for residential parcels), to a flat rate

tax for all types of parcels.

A planned parcel tax measure (in the Tam district), if passed in

November 2018, "will only partially mitigate TUHSD’s financial

strain,” Willard said in the

news release. “TUHSD hopes to increase its parcel tax at least 50

percent to $428-plus annually (though the district needs much more

than that to sustain services)".

The Tamalpais Union High School District (TUHSD)

Facilities Master Plan (FMP) for each school's long-range

needs

| |

|

|

It will cost each

property owner $30 per $100,000 assessed valuation annually .

The owner of a typical district property would see a tax

increase of $300 at the start, growing to over $500 annually

over 30 years.

Cumulative cost

would exceed $12,000 per parcel.

Board of Trustees Meeting

vote on July 18 on moving the ballot measure process

forward by hiring a campaign strategist for a bond offering

and possible parcel tax.

6PM

Location: Kreps Conference Room (Redwood HS),

Dougherty Dr., Larkspur

( shouldn't Science, Arts,

CTE and Elective Programs be 3 separate costs?) |

|

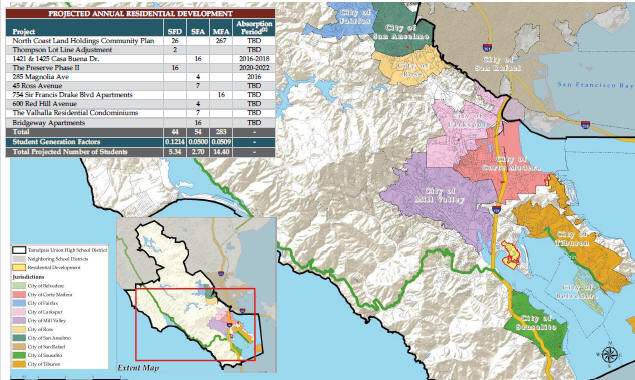

The Tamalpais Union High School District (TUHSD,

Tam District, or District) is located in the cities of

Larkspur, Mill Valley, and San Anselmo. TUHSD serves

4,679 pupils.

- Tamalpais HS -----------1,537,

- Sir Francis Drake HS - 1,142,

- Redwood HS ----------- 1,807,

- San Andreas HS ---------- 85,

- Tamiscal HS,

- Total HS Enrollment -- 4,679.

In September 2016, the District awarded the contract for

master planning services to LPA, Inc. |

| |

|

CBS TV Report |

Tamalpais UHSD Masterplan

Larkspur, CA April 12, 2017

|

|

School Site |

Total |

|

Program Scope |

Redwood HS |

San Andreas HS |

Sir Francis

Drake HS |

Tamalpais HS |

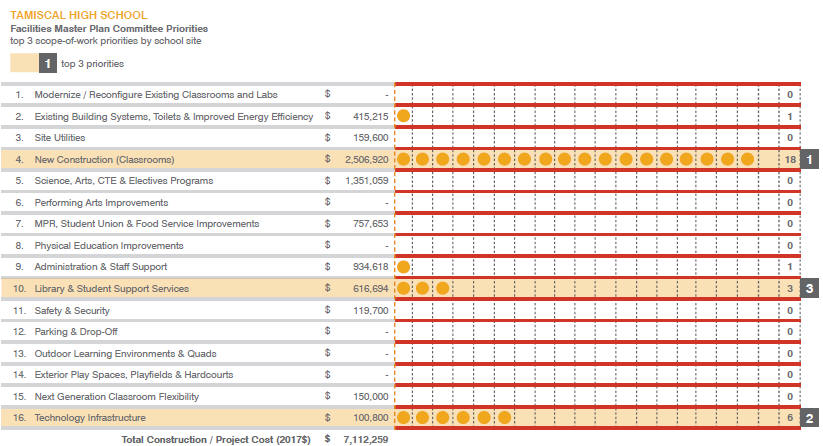

Tamiscal HS |

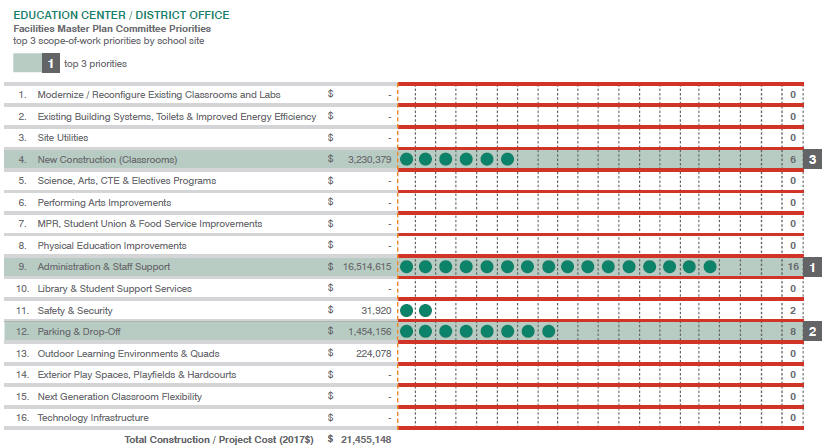

Education

Center |

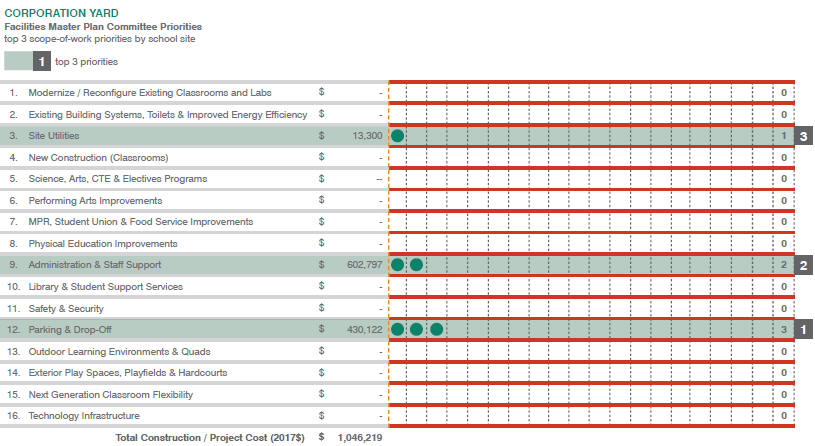

Maintenance &

Operations |

|

|

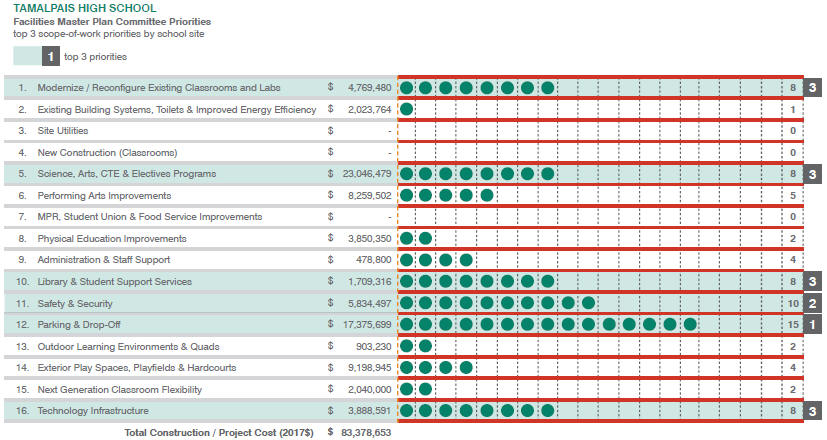

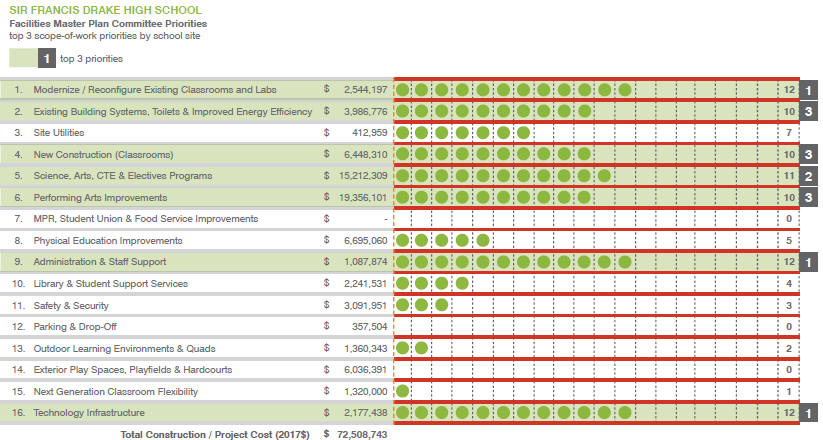

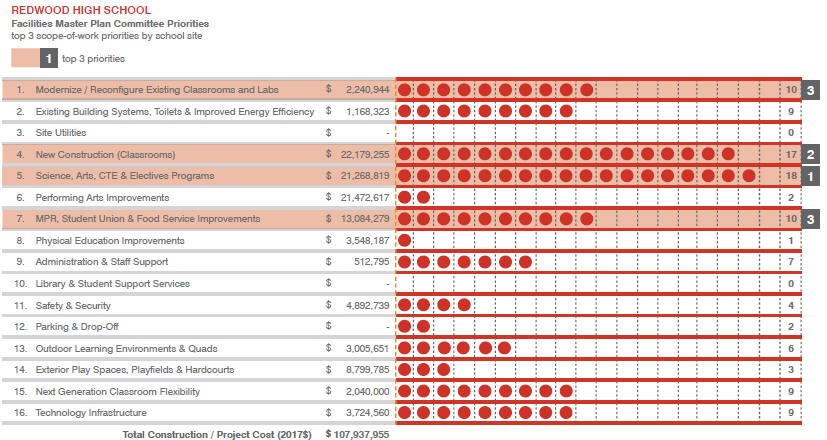

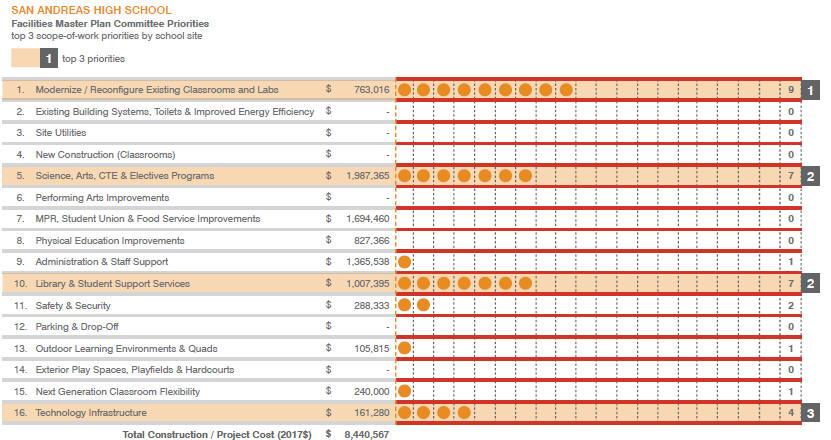

A. Modernize / Reconfigure Existing

Classrooms and Labs |

$ 2,240,944 |

$ 763,016 |

$2,544,197 |

$ 4,769,480 |

|

|

|

$10,317,637 |

|

B. Existing Building Systems, Toilets and

Improved Energy Efficiency |

$ 1,168,323 |

|

$3,986,776 |

$ 2,023,764 |

$ 415,215 |

|

|

$ 7,594,078 |

|

C. Site Utilities |

|

|

$ 412,959 |

|

$ 159,600 |

|

$ 13,300 |

$ 585,859 |

|

D. New Construction (Classrooms) |

$ 22,179,255 |

|

$6,448,310 |

|

$ 2,506,920 |

$ 3,230,379 |

|

$ 34,364,865 |

|

E. Science, Arts, CTE and Elective Programs |

$ 21,268,819 |

$ 1,987,365 |

$15,212,309 |

$ 23,046,479 |

$ 1,351,059 |

|

|

$ 62,866,031 |

|

F. Performing Arts Improvements |

$ 21,472,617 |

|

$19,356,101 |

$ 8,259,502 |

|

|

|

$ 49,088,221 |

|

G. MPR, Student Union and Food Service

Improvements |

$ 13,084,279 |

$ 1,694,460 |

|

|

$ 757,653 |

|

|

$ 15,536,392 |

|

H. Physical Education Improvements |

$ 3,548,187 |

$ 827,366 |

$6,695,060 |

$ 3,850,350 |

|

|

|

$ 14,920,964 |

|

I. Administration and Staff Support |

$ 512,795 |

$ 1,365,538 |

$1,087,874 |

$ 478,800 |

$ 934,618 |

$ 16,514,615 |

$ 602,797 |

$ 21,497,036 |

|

J. Library and Student Support Services |

|

$ 1,007,395 |

$2,421,531 |

$ 1,709,316 |

$ 616,694 |

|

|

$ 5,754,937 |

|

K. Safety and Security |

$ 4,892,739 |

$ 288,333 |

$3,091,951 |

$ 5,834,497 |

$ 119,700 |

$ 31,920 |

|

$ 14,259,140 |

|

L. Parking and Drop-off |

|

|

$ 357,504 |

$ 17,375,699 |

|

$ 1,454,156 |

$ 430,122 |

$ 19,617,480 |

|

M. Outdoor Learning Environments and Quads |

$ 3,005,651 |

$ 105,815 |

$1,360,343 |

$ 903,230 |

|

$ 224,078 |

|

$ 5,599,116 |

|

N. Exterior Play Spaces, Playfields and

Hardcourts |

$ 8,799,785 |

|

$6,036,391 |

$ 9,198,945 |

|

|

|

$ 24,035,122 |

|

O. Next Generation Classroom Flexibility |

$ 2,040,000 |

$ 240,000 |

$1,320,000 |

$ 2,040,000 |

$ 150,000 |

|

|

$ 5,790,000 |

|

P. Technology Infrastructure |

$ 3,724,560 |

$ 161,280 |

$2,177,438 |

$ 3,888,591 |

$ 100,800 |

|

|

$ 10,052,669 |

|

TOTAL PROJECT COST |

$107,937,955 |

$ 8,440,567 |

$72,508,743 |

$ 83,378,653 |

$ 7,112,259 |

$ 21,455,148 |

$ 1,046,219 |

$301,879,546 |

The votes on which projects to prioritize

Enrollment Projection

|

High School |

2017 |

2027 |

Cumulative Growth/

(Decline) |

|

Tamalpais HS |

1,537 |

1,510 |

-27 |

|

Sir Francis Drake HS |

1,142 |

977 |

-165 |

|

Redwood HS |

1,807 |

1,975 |

+168 |

|

San Andreas HS[1] |

85 |

85 |

|

|

Tamiscal HS[1] |

108 |

108 |

|

|

Total HS Enrollment[2] |

4,679 |

4,655 |

-24 |

Map of those affected by this proposed Property Tax Increase

|

Hiring Consultant

Would Further Advance TUHSD's Plan for $450 Million Bond

Measure and Parcel Tax.

The Tamalpais Union

High School District (TUHSD) will be deciding Tuesday

July 18 whether to hire a "campaign strategist" for

-

(1) a proposed

$450 million bond measure in 2018 and

-

(2) a possible

parcel tax -- of size not yet determined -- in 2020 to

cover rising operating expenses.

Contracting a campaign consultant further

propels TUHSD toward a bond offering with proceeds

directed to substantially redesigning three major high

school campuses: Redwood, Tamalpais, and Drake. The

extensive project list (Facilities Master Plan, or FMP)

was developed through an extensive consultant-directed

on-campus wish-list process that regrettably did not

include off-campus stakeholders such as taxpayers,

city planners and city councils.

The draft FMP wish list equates to the maximum

school bond measure permitted under CA laws: It

will cost each property owner $30/$100,000 assessed

valuation annually for 30 years. The owner of a

typical district property would see a tax increase of

$300 at the start, growing to over $500 annually. Cumulative cost to the

typical current Marin homeowner would exceed $12,000.

(Plans for a parcel tax are not as well developed yet.

The district believes rising expenses -- salaries,

health benefits, and pensions -- should be

addressed with a parcel tax measure.)

Now is the time to learn more and to let the board know what

you think. Each step of the process adds to

the sunk cost and inertial momentum.

Learn about the bond measure and Facilities Master

Plan:

- Marin Voice op/ed re TUHSD FMP process and bond

measure. (see below)

- Complete Draft FMP here:

For financial summary see pages 58-9 and 71

- FMP Powerpoint presentation (including

enrollment forecasts on page 50 showing a near-term

enrollment uptick, then returning to current levels)

ACTIONS:

Comment on TUHSD FMP Bond Financing

Attend

upcoming board meetings and speak during public

comment:

Tuesday July 18 - Agenda includes

approval of selection of Whitehurst/Mosher as

campaign strategist for bond and/or parcel tax

measures. Hiring the strategist would continue

forward momentum toward a potential $450 million

bond measure to fund major campus overhauls and/or

a parcel tax for rising operating expenses.

TUHSD meetings start at 6PM

Location: Kreps Conference Room (Redwood HS),

Dougherty Dr., Larkspur

Email TUHSD directors with your thoughts

about FMP and bond financing:

Laura Anderson, President:

landerson@tamdisrict.org

Leslie Lundgren, Clerk:

llundgren@tamdistrict.org

Barbara Owens, Director:

bowens@tamdistrict.org

Michael Futterman, Director:

mfutterman@tamdistrict.org

Chuck Ford, Director:

cford@tamdistrict.org

|

Marin Voice: Tam

bond measure needs input from all stakeholders

By Robert Miltner and Laura Effel

POSTED: 07/12/17, 9:45 AM

PDT

At a Tamalpais Union High

School District board meeting on July 18, the trustees

will consider adopting a “Facilities Master Plan” to

overhaul Redwood, Tamalpais and Sir Francis Drake high

school campuses.**

Implementation would require a bond of $450 million for

us taxpayers to vote on. With interest, this could cost

nearly $1 billion.

You didn’t get notice? Hardly anyone did.

Stakeholders whose views were solicited in drafting this

Facilities Master Plan did not include taxpayers. Only

students, teachers, administrators and parents counted

as stakeholders.

So, the draft master plan looks like a wish list, not a

budget for addressing urgent needs or considering

available funds.

If you knew to look for the Facilities Master Plan draft

on the district’s website, you would find the proposed

project list, which seemingly totals $300 million. The

draft mentions items “excluded from this budget.”

Only by attending the district’s board meeting of June

13 or by watching the video recording of it would you

have learned from the district’s consultant that the

amount of additional “excluded item” costs would be $150

million, raising the project’s total

construction-related tab to $450 million before interest

expense.

A bond measure to fund this would increase property

taxes $300 annually on a home in the district with an

assessed value of $1 million.

For bond measures, there is no exclusion for senior

citizens.

The high schools in this district are already excellent

schools. We are rightly proud of their high quality.

That said, we believe this proposal is vastly out of

reach.

The current tax burden on homeowners is not

inconsiderable, and taxpayers have become aware that

public agencies are not prudent in using our money.

A few examples: $1 billion of unfunded employee

retirement benefits, the SMART train’s serious financial

shortfalls, a possible Marin transportation sales tax

increase above the state-mandated limit, repeated

increases in water rates — and the list goes on.

Many of us are sensitive to any new proposals for more

taxes.

More important, this proposed Facilities Master Plan

falls outside of what is needed.

We have spent time in the corridors and rooms of these

schools, attended sporting and performance events and

been to many meetings with teachers and school

administrators. The facilities never seemed inadequate;

nor did the kids complain that they wished the schools

had more this, or better that.

The teachers themselves were the most important

resource. And for good reason, as the faculty members

were, and surely still are, outstanding.

Despite the lack of inclusiveness of the Facilities

Master Plan process, we do not believe the district

intended to sneak up on us taxpayers, as it appears to

have done.

The trustees all seem to be caring public servants who

listen and want to do what is right. But they have

gotten swept away by a process they are now finding

difficult to stop.

With your encouragement they can stop or scale back this

out-of-control process.

If the board approves the Facilities Master Plan at the

July 18 meeting, the next step would be for the board to

vote to approve a bond measure for the ballot.**

This could happen as early as late July. We urge you to

become informed, weigh in, and attend the July 18 board

meeting.

Robert Miltner and Laura Effel are residents of

Larkspur. Mr. Miltner’s two children graduated from

Redwood and are now in graduate school at Ivy League

campuses.

the board will vote

on July 18 on moving the ballot measure process forward

by hiring a campaign strategist for a bond offering and

possible parcel tax.

|

|

|

|