Why You

Should Get Security Freezes BEFORE Your Information is Stolen

U.S. PIRG Education Fund Mike Litt and Edmund Mierzwinski October 2015

-

Contents

Summary

1

Peace of Mind

1

Best Options against New Account Identity

Theft

2

How Stolen Data is Used

3

Financial Identity Theft

3

Tax Refund Fraud or Medical Services

Fraud

3

Reputational & Physical Harm

3

Warning: If a Thief Gets Some of the

Information, Phishing is How They Try for More

4

Some Recent Breaches

4

Detection vs. Prevention

6

Credit Monitoring

7

Identity Protection Services:

8

Fraud Alerts By Law:

9

How to Apply for Fraud Alerts

9

Security Measures for Existing Credit

Accounts

10

What is Social Engineering? What is

Phishing?

11

I’m an Identity Theft Victim! What

Should I Do?

12

The Security/Credit Freeze

14

Main Features of a Security Freeze

14

How to Freeze (and Unfreeze) Your Credit

Reports

16

Placing and Lifting a Security Freeze

with Each Credit Bureau

16

How to Get Free Credit Monitoring

18

Use Your Free Annual Credit Reports

18

Other Free Credit Reports

20

Also: Opt Out of Pre-approved Credit &

Insurance Offers

20

Conclusion

21

Appendix A: AVOIDING IDENTITY THEFT

22

DETECTING IDENTITY THEFT

23

Endnotes

24

A never ending stream of news reports about data breaches – including

T-Mobile, Target Corporation, the IRS, numerous Blue Cross Blue Shield

and other health plans, the University of Maryland, and the U.S. Office

of Personnel Management (OPM) - is a constant reminder that you’re at

risk of a data breach and therefore, identity theft if you:

-

Shop with credit or debit cards;

-

Pay taxes;

-

Have health insurance;

-

Attend college;

-

Patronize any business that keeps customer

records; or,

-

Work for the government or a company

These constant breaches reveal what’s wrong with data security and

data breach response. Agencies and companies hold too much information

for too long and don't protect it adequately. Then, they might wait

months or even years before informing victims. Then, they make things

worse by offering weak, short-term help such as credit monitoring

services.

The first defense against any kind of identity theft is to be vigilant

about protecting your personal information by taking steps like

creating secure passwords, installing anti-virus and anti-malware

software, and shredding personal documents. (See Appendix A for more

tips on protecting your personal information.) However, if and when

someone does steal enough of your information to commit identity

theft, there is really only one type that you can stop before it

happens: New account identity theft, where someone opens a new account

in your name. All other types of identity theft and fraud, at

best, can only be detected after the fact. Unfortunately, the services

and steps that are most offered and recommended to consumers are the

ones that only detect identity theft or fraud but don’t stop it.

Whether your personal information has been stolen or not, your best

protection against someone opening new credit accounts in your name is

the security freeze (also known as the credit freeze), not the

often-offered, under-achieving credit monitoring. Paid credit

monitoring services in particular are not necessary because federal

law requires each of the three major credit bureaus to provide a free

credit report every year to all customers who request one. You can use

those free reports as a form of do-it-yourself credit monitoring.

Credit monitoring only lets you know after someone has opened a new

account in your name. A security freeze, on the other hand, prevents

new accounts from being opened in the first place.

How does a security freeze prevent new accounts from being opened? It

works by blocking your credit report from being shared with potential

new creditors, such as banks or credit card companies. Most creditors

will not issue new credit to a customer if they cannot see that

customer’s credit report or score derived from it from at least one of

the three major national credit bureaus. So if a thief applies for a

new account in your name with your Social Security number and

his or her own address, but your credit report is frozen,

creditors will simply not open a new account. That’s why a security

freeze offers peace of mind and is the only way to prevent someone

from opening a new account in your name. (Note: Some creditors, such

as some cell phone and utility companies, may not check with the

bureaus before opening new accounts.)

So, the best course of action for most consumers is to place security

freezes with the three major credit bureaus. Consumers

in every state can choose to have their credit reports frozen until

they want to apply for credit, at which time they can easily unfreeze

or “thaw” their reports by lifting their freezes.1

Consumers who choose a security freeze should account for the time it

can take to thaw their reports if they want to apply for credit in the

future. In most cases if you request a thaw online or over the phone,

your report can be unfrozen within 15 minutes.2

However, it can take longer if you don’t have your PIN number

that was assigned to you when you froze your report. By law, credit

bureaus have up to three days of receipt of your request to lift a

freeze.

This report explores the best options you have against new account

identity theft, walks you through freezing and unfreezing your credit

reports and explains defenses against other types of identity theft.

These steps are recommended for all consumers whether their

information has been stolen in a data breach or not:

-

Place a security freeze, also known as a

credit freeze, on your credit report at each of the three major

national credit bureaus – This is the ONLY reliable prevention of

someone opening new financial accounts in your name.

-

Next steps, after placing security freezes

include:

-

Use your free annual credit reports as a

form of “free credit monitoring.”

-

Opt out of allowing your credit reports

to be used to generate pre-approved (pre-screened) credit &

insurance offers.

In addition to the above steps, the following steps are also

recommended for consumers whose information has been stolen

in a data breach:

-

Sign up for free ID protection services

and credit monitoring, if they are offered for free as a result of

your personal information being stolen.

-

Place free, renewable fraud alerts on your

credit report (if your Social Security number was stolen and if you

decide not to place security freezes on your credit reports.)

-

Additionally,

Identitytheft.gov is the

government’s official website that will walk you through clear

checklists of actions you can take to recover from identity theft.

-

From 2005 to October 27, 2015, there have been over 4,600 data

breaches in the United States. Over 889,500,000 records have been

breached.3

This year alone, from January 2015 to October 27, 2015, there have

been well over 100 data breaches affecting over 153,000,000 records.

These statistics are a low estimate.4

Many of these data breach victims are at risk of identity theft of one

form or another. Once data is stolen, there are a variety of ways it

can be used, depending on how much data was taken:

-

-

Existing Account Fraud:

If a thief obtains a full name and credit or

debit card number, the thief can access existing bank and credit

accounts for in person transactions, which do not require the

Card Security Code on the back of cards that online transactions

require.

-

New Account Identity

Theft: With a full name and Social Security

number (SSN), a thief can open up new credit accounts.

-

Fraud on existing accounts is considered identity theft under

federal law – this is to make sure consumers receive strong

protections and banks are incentivized to stop such fraud.

However, most data security advocates reserve the term “identity

theft” for the much more serious, although less common, crime of

establishing new accounts in other peoples’ names.

-

-

With a full name, SSN and a birthdate (and sometimes an existing

health insurance account number), a thief can attempt to receive

benefits and services in your name.

Some breaches involve personal information that can be used to

blackmail, stalk, or otherwise inflict reputational or physical harm

against data breach victims.

Even if the thief only obtains some of your information - for example,

if he/she didn’t get your card info or SSN but obtained phone numbers

or e-mail addresses - watch out! The thief can use social engineering

or “phishing” scams to attempt to collect more information needed to

commit any of the above more severe crimes. Also, you can still be a

victim of “phishing” even if none of your information was stolen in a

data breach

because a lot of personal information is already available on the

internet. See one of the next sections on “What is Social Engineering?

What is Phishing” for more information.

-

The following chart provides examples of different types of crimes and

techniques involved in recent data breaches:

|

*When Reported |

# of Records |

Existing Credit Card or Checking Acct Fraud |

Phishing for More Info |

New Acct ID Theft |

Tax Refund Fraud |

Medical Services Theft |

Reputation/ Physical Harm |

|

Excellus Blue Cross Blue Shield5 |

Sept 2015 |

~10 million |

X |

X |

X |

|

X |

X |

|

Experian6 |

Oct 2015 |

~15 million |

|

X |

X |

X |

|

|

|

IRS7 |

May 2015 |

Up to 330,000 |

|

X |

X |

X |

|

|

|

Michael’s8 |

Jan 2014 |

~3 million |

X |

|

|

|

|

|

|

OPM (2

breaches)9 |

April & June 2015 |

~26 million |

|

X |

X |

|

|

X |

|

Target10 |

Dec 2013 |

~110

million |

X |

X |

|

|

|

|

*Note that we use the date that breaches were reported to the

media. Breaches may have occurred or been discovered earlier. In some

cases, all victims may still not have been personally notified.

Blue Cross Blue Shield Health Insurance Plans: Several

breaches have affected affiliates of Blue Cross Blue Shield, but the

breaches may have affected customers of other health plans whose

family members may, for example, have received out-of-network care at

a breached

plan. Information breached could allow new account identity theft or,

in some cases, theft of medical services.

-

Anthem – A

breach of the nation’s second largest health care plan, California’s

Anthem, in February 2015, is estimated to have affected 80 million

consumers, but was not reported to have included health information.

-

Premera—The

March 2015 breach of the Pacific Northwest affiliate Premera, affected

11 million customers and is reported to have included health-related

information.

-

CareFirst—In

May 2015, the DC-area affiliate CareFirst reported a breach affecting

over 1 million customers. The company says Social Security numbers and

health care records were not breached.

-

Excellus: In

August 2015, the upstate New York Blue Cross affiliate Excellus

reported a breach affecting over 10 million customers. Excellus has

reported that attackers “may” have obtained Social Security numbers,

membership numbers and claims information as well as other personal

information. (The company has also determined that evidence shows that

the breach may have begun in 2013. Such a pattern of delayed discovery

and reporting is probably true of other breaches in this list.)

Experian and T-Mobile: On October 1, 2015, wireless

phone company T-Mobile announced that data for 15 million of its

customers and applicants had been stolen from Experian computers.

T-Mobile uses Experian, one of the three big national credit bureaus,

to conduct credit application review for applicants before opening new

accounts. Lost data includes names, addresses and birth dates and

Social Security numbers, among other information breached from the

consumer files.

This breach is particularly concerning because credit bureaus are

subject to very high security standards, but losing Social Security

numbers -- the keys to new account identity theft – makes this breach

much worse. Experian, which lost the data, offered its own branded

“ProtectMyID” credit monitoring for two years. It has also offered

other services, including internet scans for personal information and

access to identity theft resolution specialists – these types of

services are further explained in the “Detection VS. Prevention”

section of this report. T-Mobile has also offered an alternative

credit monitoring service with CSID.11

Experian has denied that its consumer reporting (credit bureau)

servers were breached.12

Internal Revenue Service (IRS): In February, some

state tax officials and then the private tax filing firm Turbotax

temporarily suspended online tax filing following reports of

widespread fraudulent theft of state tax refunds. In May 2015, the IRS

reported its own breach as initially affecting 100,000 taxpayers; in

August the estimate was raised to over 334,000. Breached

information included prior year tax returns. The breach was enabled

using SSNs, DOBs, tax filing status, address, and personal security

questions from multiple sources.

In October 2015, the IRS announced new efforts to fight fraudulent tax

returns13. These efforts include an agreement

among the IRS, states and tax preparation companies to share

suspicious activity on 20 data points on tax returns to help spot

fraud sooner. Additionally, tax preparation companies will ask tax

filers three identity verification questions and require more secure

passwords. Software companies will also notify customers when changes

are made to their accounts or if second tax refunds are filed using

their Social Security numbers.

Michaels Stores and Target Corporation: In

December 2013, Target Corporation announced it was the victim

of a retail credit and debit card breach initially affecting 40

million customers at the cash register. The number affected was later

increased to 70-110 million customers, after it was determined that

thieves also had access to backroom computers containing details of

registered Target customers or Target-branded cardholders. In general,

the first set of consumers faced a large risk of existing account

fraud. The second set of consumers were also at risk of phishing

scams—even though their Social Security numbers were not included in

the theft, thieves could use their email addresses or phone numbers to

try to obtain this additional information, which would make it easier

to commit new account financial fraud. In January 2014, Michael’s

Stores reported a similar breach of credit and debit card data

affecting over 3 million customers.

-

Office of Personnel

Management (OPM): In April and June 2015, OPM

reported on breaches affecting 26 million federal employees, as

well as their spouses, co-workers and friends listed as references

on security clearance applications. Information breached may have

included dates-of-birth, Social Security numbers, fingerprints,

usernames & passwords, personal info from interviews and

information obtained in security investigations which could be

used not only for new account identity theft but also to damage

reputations or commit espionage (for example, reports of arrests,

whether or not convicted, prior drug use, marital affairs, etc.)

The first defense against any kind of identity theft is to be

vigilant about protecting your personal information by taking

steps like creating secure passwords, installing anti-virus and

anti-malware software, and shredding personal documents. (See

Appendix A for more tips on protecting your personal information.)

However, if and when someone does steal your information, there is

only one type of identity theft that can actually be prevented

before it

happens: New account identity theft, where someone opens a new

account, such as a credit card, bank account, or loan in your

name. And for this type of fraud, a security freeze is the best

line of defense and the only way to achieve peace of mind. All

other types of identity theft and fraud, at best, can only be

detected after the fact.

Unfortunately, the services and steps that are most offered and

recommended to consumers are the ones that only detect fraud.

These services and steps include credit monitoring, identity

protection services, and fraud alerts that can be placed on your

credit reports by law.

Depending on your circumstances, you might decide one or more of

these are right for you. But you should know the limitations of

each:

Credit monitoring is often offered to data breach victims for free

and is also available for purchase to all consumers for a monthly

fee ranging from $9.99/month-$19.99/month or more. The range of

features varies but can include access to one or more of your

credit reports, monitoring of one or more of your credit reports,

alerts on changes to your report(s), access to one or more of your

FICO scores, monitoring of one or more of your FICO scores, and

alerts on changes to your score(s).

Credit monitoring doesn’t prevent any type of fraud and can only

detect one type: new account fraud, where someone opens a new

account in your name. If consumers don’t know about the following

shortcomings, credit monitoring may even provide a false sense of

security.

Does Not Help With Existing Account Fraud

Credit monitoring is not able to prevent or even detect fraud on

existing accounts. Banks and credit card companies have their own

security measures in place to prevent, detect, and resolve such

fraud. (We discuss these measures in further detail in the

“Security Measures for Existing Credit Accounts” section of this

report.)

Does

Not Prevent Fraud

Credit monitoring services don’t prevent any type of fraud. They

only alert you after

new financial accounts have been opened in your name.

Still Might Not Catch New Account ID Theft!

Consumers should be further aware that fraudulent accounts opened

in your name still might not be caught if the service doesn’t

monitor your credit reports at all three major national credit

bureaus.

Target, for example, offered their customers a free version of

Experian’s ProtectMyID service after its 2013 holiday season data

breach. This free version only monitored

consumers’ Experian credit reports, making it possible for any

fraudulent activity on consumers’ Equifax and TransUnion reports

to go undetected.14 Also, these “free”

services are generally provided for a limited time, up to a year

or 18 months.

Paid Services Charge You Monthly

In particular, these services should not be paid for because it is

already possible to monitor your own credit by staggering requests

for your free annual credit reports available by law. We

acknowledge that a credit monitoring service might detect theft

faster than you might on your own, depending on when the theft

occurs and when you check your reports. But is it worth the $10 -

$20 or more in monthly fees to find out about theft after someone

has already attempted to or successfully opened a new account in

your name when you can monitor your own accounts and prevent such

activity with less costly security freezes?

Note: It doesn’t hurt to take free credit

monitoring and identity protection services if you have been a

victim of a data breach. If you already have security freezes

placed on your credit reports when your information is stolen,

there is really no need for credit monitoring because there won’t

be anything to monitor. But if other identity protection services

like the ones listed below are part of what is offered, it doesn’t

hurt to take the whole package offered. If you already have

freezes on your reports, you will need to lift your freezes before

signing up for the credit monitoring and reinstate your freezes.

If you don’t have freezes on your credit reports yet, sign up for

the free credit monitoring first, then place your freezes.

Some of these services are sometimes offered to data breach

victims and are also available for purchase to all consumers for a

monthly fee. The range of service features varies but can include:

Scanning of Personal Information

These features scan the dark corners of the internet and public

(and in some cases nonpublic) records to detect any changes in or

selling of your personal information. These types of scans and

surveillance could be helpful in detecting fraud besides new and

existing account fraud, such as crime committed in your name.

Identity Theft Insurance

This is a feature that reimburses you for costs incurred from

identity theft. It’s worth noting that you might already have some

sort of insurance or equivalent protection from fraud resulting

from id theft that is extended to you voluntarily by your

employer, your insurance company (as a rider on your existing

homeowner’s or renter’s

insurance), or your credit card issuer (as a perk), etc. It’s also

important to point out that

ID theft insurance, whether offered free or as part of a service

that you’re paying for always has limitations, exclusions, and

requirements and usually only covers incidental expenses to clear

ID theft problems up such as postage and notary fees. It doesn’t

usually reimburse you for money that’s been stolen from you, and

if it claims to cover attorney’s fees, remember that such coverage

is usually extremely limited.15

Identity Theft Resolution

In the event of identity theft, a specialist will assist you in

contacting the right people and going through the right steps.

Some services claim that they will do all the work for you.16 While this feature can be helpful, these

steps can also be found on identitytheft.gov and be done by

yourself for free.

Fraud alerts are recommended for consumers whose information was

stolen in a data breach. Active military have additional

protections.

By law, it is possible to place renewable fraud alerts on your

credit reports for free for 90 days at a time. These alerts will

let a creditor know that they should not approve a line of credit

without verifying your identity first, which means they might try

to contact you. However, just know that creditors are not

legally bound to get your approval first before issuing

credit, although they do face greater legal liability if they do

not take further verification steps.

When you sign up for a fraud alert with one credit bureau, it is

required by law to contact the other two major credit bureaus on

your behalf to file fraud alerts with them too. If you are not

a victim of identity theft fraud, you will have to renew these

alerts every 90 days.

If you have been a victim of identity theft you can sign up for an

extended fraud alert for seven years without having to renew it

every 90 days.

This requires filling out an identity theft report, which is made

up of an identity theft affidavit

and a police report - both steps are walked through at

identitytheft.gov. If you are on active

military duty, you can sign up for these alerts for one year,

whether you are a victim of identity theft or not – your name will

also be removed from pre-approved credit offers for two years.17

How to Apply for Fraud Alerts

Equifax

Online: https://www.alerts.equifax.com Phone:

1-888-766-0008

Experian

Online: https://www.experian.com/fraudalert (Click on

the “Add An Initial Security Alert for 90 Days” button or select

“Add a Fraud Alert Message” and click the “Continue” button for

extended and active duty alerts.

Phone: 1-888-397-3742

TransUnion

Online: http://www.transunion.com/fraud Phone:

1-800-680-7289

Innovis (This is a fourth, smaller bureau. Fraud

alerts with Innovis do not get shared to or from the three major

credit bureaus above. If you want an alert placed with Innovis,

you need to do it separately from the other three bureaus.).

Online:

https://www.innovis.com/fraudActiveDutyAlerts/index Phone:

1-800-540-2505

Mail: Send this form (https://www.innovis.com/pdf/InnovisFraudandActiveDutyAlertRequest.pdf)

Walk in: 875 Greentree Road, 8 Parkway Center, Pittsburgh PA 15220

Many banks and credit card companies already have mechanisms in

place to detect fraudulent use of existing accounts and remove

unauthorized purchases. Also, nearly all credit and debit cards

are being replaced with “chip” cards. In a related development, by

October 1, 2015, most bigger merchants replaced their “swipe”

terminals with “swipe or dip” terminals. A “chip” card that is

dipped does not transfer your account number to the merchant’s

computer at all, greatly reducing the odds that you will be a

victim of in-person retail fraud. The chip also makes it harder

for crooks to take your account information and create a

counterfeit card to use for purchases.

However, online fraud could still occur, so we advise using credit

cards, not debit cards, for online purchases, if you have a credit

card and are confident you can avoid the real risk of piling up

excessive credit card debt. There are some online PIN debit

systems that work, but most banks do not yet allow their use. Your

legal rights are substantially stronger with a credit card; plus,

you don’t face the risk of waiting for the bank to replace money

into your checking account after a fraud investigation involving

your debit card. (Provided a consumer has not lost the debit card

itself, she or he has up to 60 days to notify the bank of

fraudulent activity on a debit card to face zero liability.

However, some liability kicks in after just 48 hours if you’ve

actually lost the card).

Of course, consumers should also check their statements regularly

to detect any fraudulent purchases. It is also recommend that

consumers check their online accounts frequently and not just wait

for their statements – this can be done safely as long as

precautions are taken to keep computer and/or mobile devices

secure. You can also set up either text messages or email alerts

to notify you of transactions. Many financial institutions allow

you to set parameters for specific notifications, such as online

transactions and transactions over a dollar amount you specify.

Even if enough personal information hasn’t been stolen in a data

breach to commit fraud, we remind you that bad guys will try to

use what was stolen or take advantage of publicly available

information to trick you into providing the “keys” to identity

theft, such as your SSN. They may also try to obtain passwords,

full account numbers or security codes in this manner. Typically,

these attempts come in the form of spam emails or messages on

social media from well-known companies, prompting you to reply

with personal information or to click on a link or attachment that

will download malware onto your computer and steal personal

information. This is called a social engineering or “phishing”

scam. A bad guy may call and say “I am from the bank security

department; I will verify that by reading the last four digits of

your account number. Now, please confirm I am speaking to the

correct consumer by reading me the security code on the back of

the card.” Of course, many consumers don’t realize that the last

four digits of account numbers are widely available but security

codes are not.

Such attempts tend to increase after well publicized data

breaches, as other identity thieves, even wannabees not involved

in the initial theft, will take advantage of heightened fears of

identity theft and try to “verify” additional personal information

for “security precautions.”18 The current

“scam of the day” is to call consumers concerning the widely

publicized, but slow, transition to “chip” credit and debit cards

and attempt to scare them into giving up their account numbers and

security codes.

Identity thieves will also take advantage of the tons of

information now available in a two- second google-search or for

sale on an underground network (these networks are generically

called the “darknet”).

They’ll contact you personally and try to impress you with what

they already know (“come on, I know so much, I must be

legitimate”), so that they can get more. When phishing is directed

towards a particular person, it is called a “spear phishing” scam.19 If someone calls you and says “I am from

your bank,” hang up and call the number on your card, not the

number they give you. And certainly don’t call any numbers or

click on any links in any email supposedly “from

your bank.” There is an even more nefarious version of this scheme

against senior employees of a company, bank or government agency

who may unwittingly grant the thief deeper access to a particular

computer containing military, financial or corporate secrets. So,

while information may be obtained on millions of consumers, the

true target list may be smaller.20

Summary: Remember that any bad guy with some

information about you wants to “phish” for even more to fill in

the blanks. Don’t click on email links; don’t call the numbers in

emails or provide information to “corporate security” when they

call. Instead, hang up and call the number on your bank card. You

may indeed get a legitimate call or message from your bank or

someone else you have an account with asking to verify a

transaction because fraud is suspected – but in that case, they

won’t ask for your account number or other personal information

because they already have it.

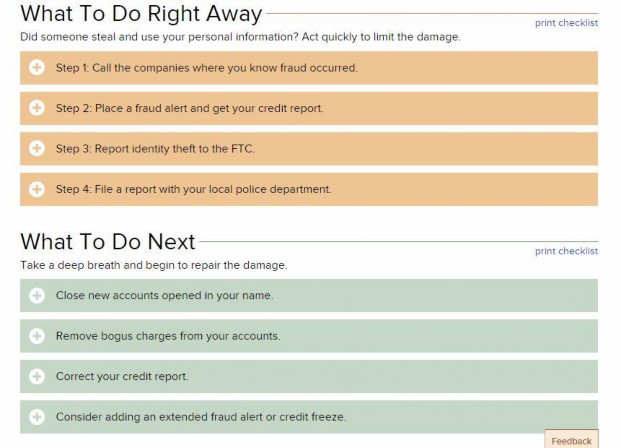

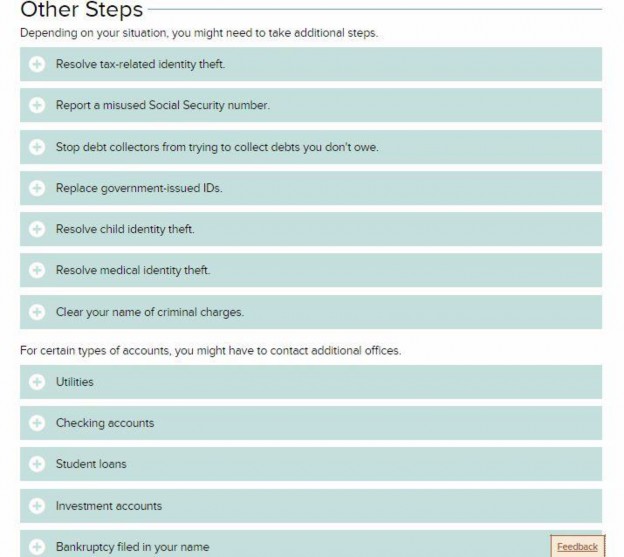

Identitytheft.gov is the government’s

official website that will walk you through clear checklists of

actions you can take to recover from identity theft. Here are

examples.

What is It?

A security freeze, also known as a credit freeze, works by

preventing your credit report from being shared with potential new

creditors, such as banks or credit card companies.

Ok, so what’s my credit report again?

Your credit report is a record of your credit history and is used

to determine your credit score – potential new creditors look at

both your credit report and credit score to decide whether to

extend you credit and at what interest rates. (Credit reports are

also used for employment and insurance decisions.) There are three

major national credit bureaus, also known as credit reporting

agencies: Equifax, Experian, and TransUnion. Each bureau

has its own report and score for you. Mortgage companies may check

all credit reports; other creditors may check only one or two,

depending on what region of the country you live in, or what sort

of or amount of credit you are applying for. There is also a

newer, fourth smaller national credit bureau, Innovis, used

primarily by creditors buying lists of consumers for marketing

(prescreening) purposes, not (so far) for credit decision-making.

All of these national bureaus accept security freezes.

The

Bottom Line

Most creditors will not issue you new credit if they cannot see

your credit report first. So if a thief applies for a new account

in your name, but your credit report is frozen, creditors that

cannot see it will simply not open a new account. That’s why a

security freeze placed on your credit report at each of the three

major national credit bureaus offers peace of mind and is the only

way to prevent someone from opening a new account in your name.

(Note: Some creditors, such as some cell phone and utility

companies, may not check with the bureaus before opening new

accounts.)

-

You can easily “unfreeze” your

credit report when you want to apply for new credit. Freezes can

be temporarily or permanently lifted when you want.

-

A security freeze does not affect

your credit score. In fact, a security freeze helps protect your

score by preventing your credit from being negatively scored if

someone tries to fraudulently apply for credit in your name.

This is because you can potentially lose points every time your

credit report is checked by a new creditor when you apply for

credit. Your credit score is what potential creditors look at

when deciding to give you credit. (Feel free to look at your

credit score or report as often as you want; your own inquiries

have no effect on your score.)

-

Your credit will continue to be

scored for your use of existing credit. In other words, a

security freeze does not affect your ability to use existing

credit you already have, such as a credit card or loan, nor does

it prevent existing creditors from reviewing your continued

eligibility for current or additional credit.

-

Debt collection companies acting on

behalf of credit companies you already have a relationship with

can still access your credit report. Also, according to the FTC,

“government agencies may have access in response to a court or

administrative order, a subpoena, or a search warrant.”21

-

Security freezes are available to

consumers in all 50 states and the District of Columbia. A

security freeze costs between $3-10 for each of the three big

national credit bureaus, depending on the state. (There is no

fee to place a freeze with the fourth, smaller bureau, Innovis.)

There is a $2-12 fee, depending on the state, for unfreezing

your credit report with each bureau. All states give you the

right to place free security freezes if you can prove that you

are an identity theft victim. Some states offer them for free to

consumer 65 years+. There are seven states where freezes are

free to all consumers, whether they are identity theft victims

or not22:

-

Colorado (first freeze is free)

-

Indiana

-

Maine

-

New Jersey

-

New York (first freeze is free)

-

North Carolina (free online only)

-

South Carolina

Lifting freezes both temporarily and permanently is free to

all consumers in: D.C., Delaware, Indiana, Maine, North

Carolina, South Carolina, Tennessee, and Virginia.

Lifting freezes permanently (but not temporarily) is free to

all consumers in Alaska, Idaho, Missouri, Montana, Nebraska,

North Dakota, and Pennsylvania.

You can see all applicable fees for you state on Equifax’s

“Security Freeze Fees and Requirements” webpage:

http://bit.ly/1LUIF0P

-

Security freezes can also be placed

by parents and legal guardians of minors and medically

incapacitated consumers. Why a security freeze for children?

Security freezes can stop child identity theft, a growing

problem that might not be discovered for years. Twenty states

require credit bureaus to offer security freezes for minors.23 The credit bureau

Equifax is now providing them in every state.

-

Warning:

It is important to note that neither credit monitoring nor a

security freeze can detect or prevent unauthorized use of your

existing credit accounts, tax refund fraud,

medical fraud, or reputational or physical harm, by thieves. A

security freeze prevents identity theft on new accounts, such as

credit cards, loans, and bank accounts.

-

It is recommended you freeze your

credit report with at least the three main credit bureaus

(Experian, Equifax and TransUnion). Unlike fraud alerts, placing

a freeze with one bureau does not automatically freeze your

account with the other bureaus. You have to place a freeze with

each bureau where you want one. Some creditors use one, while

some will use the others, so your best coverage is to freeze all

three.

-

You will receive a PIN number for

your security freeze with each bureau. You will use this PIN

number when you want to unfreeze your credit report any time you

want to apply for new credit.

-

If you want to temporarily lift a

freeze because you are applying for credit or a job, try to find

out which credit bureau the business uses to check credit

reports. You can save some money and time by only lifting your

freeze for that credit bureau.

You can temporarily lift a freeze for a specific period of time,

from one day to one year, in all states. In 29 states and the

District of Columbia, you also have the option of temporarily

lifting a freeze for just a particular creditor that you

specify. You can see all applicable fees for you state on

Equifax’s “Security Freeze Fees and Requirements” webpage:

http://bit.ly/1LUIF0P

-

Make sure to account for the time it

can take to thaw your report. In most cases if you request a

thaw online or over the phone, your report can be unfrozen

within 15 minutes. However, it can take longer if you don’t have

your PIN number that was assigned to you when you froze your

report, so make sure to keep your PIN number in a safe,

memorable place where you can quickly retrieve it when needed.

By law, credit bureaus have up to three days of receipt of your

request to lift your freeze.

You can place a freeze online, over the phone, or in writing.

Equifax

Online:

https://www.freeze.equifax.com

Phone: 1-800-685-1111 (NY residents please call 1-800-349-9960)

Mail: Equifax Security Freeze, P.O. Box 105788, Atlanta, Georgia

30348

Experian

Online:

https://www.experian.com/freeze/center.html Phone:

1-888-397-3742

Mail: Experian Security Freeze, P.O. Box 9554, Allen, Texas

75013

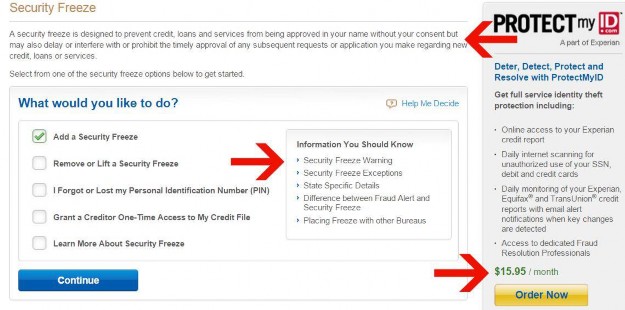

Experian includes a potentially confusing three paragraph

“Security Freeze Warning.” They are just explaining that you

will need to unfreeze your credit report before applying for

credit if you ever wish to do so in the future. You might also

notice right next to their warning is an offer to purchase their

credit monitoring service for $15.95 a month – again, the

security freeze is the ONLY way to prevent new accounts from

being fraudulently opened in your name and is much cheaper than

paid credit monitoring.

Figure (Arrows are ours to show Experian’s

warnings and sales pitch)

TransUnion

Online:

http://www.transunion.com/securityfreeze

Phone: 888-909-8872

Mail: TransUnion LLC, P.O. Box 2000, Chester, PA 19022

Innovis (smaller, new bureau)

Online:

https://www.innovis.com/personal/securityFreeze Phone:

1-800-540-2505

Mail: Fill out this form (https://www.innovis.com/pdf/InnovisSecurityFreezeRequest.pdf)

In person: 875 Greentree Road, 8 Parkway Center Pittsburgh, PA

15220

Fun Fact: We worked on the original Security Freeze Law

We worked on the first security freeze law, in California, and

then promoted it nationwide, state by state, with a model

data breach notice and security freeze law24,

written with Consumers Union/ Consumer Reports and also promoted

by many state AARP chapters.

Between 2005 and 2009 a version was passed by nearly every

state, forcing the credit bureaus to eventually provide the

freeze everywhere.

Federal law requires each of the three major credit bureaus to

provide a free credit report every year to all customers who

request one.25

If you stagger a request for a report from one of the three

credit bureaus every four months or so, you've got free credit

monitoring! Even if you choose to do a security freeze, it is

still advisable to request and monitor your free annual credit

reports.26

You can request your free credit reports online, over the

phone, or by mail.

Online: annualcreditreport.com

– this is the official website authorized

by the government for requesting these reports. Make sure to

type this accurately. As of the printing of this report,

misspelled websites are currently inactive but have existed in

the past to misdirect people to unofficial services.

Phone: 1-877-322-8228.

Mail: Complete the Annual Credit Report Request

Form (http://www.consumer.ftc.gov/articles/pdf-0093-annual-report-request-form.pdf)

and mail it to:

Annual Credit Report Request Service

P.O. Box 105281 Atlanta, GA 30348-5281.

If you want your Innovis credit

report, you will need to request it directly from them by phone

(1-800-540-2505), mail (send in this form: https://www.innovis.com/pdf/InnovisCreditReportRequest.pdf),

or walk-in (875 Greentree Road, 8 Parkway Center, Pittsburgh, PA

15220).

Additional Free Annual Reports

Consumers in each of the following seven states can get an

additional free report from each bureau each year under state

law: Colorado, Georgia (two additional reports), Maine,

Maryland, Massachusetts, New Jersey, and Vermont.27

An additional free annual report is also available to consumers

in all states for people that are unemployed and intend to apply

for employment within 60 days, are receiving public welfare

assistance, believe their credit report contains inaccurate

information because of fraud, or have received adverse action

like denial of credit or insurance in the last 60 days.

Additionally, if you have already received your free annual

reports this year but have since placed a fraud alert, you can

follow the instructions in your fraud alert confirmation letter

to get an additional free report.28

Reduced fees for additional annual reports are available to all

consumers in: California ($8), Connecticut ($5), Minnesota ($3),

and Montana ($8.50).29

All consumers in all other states can be charged no more than

$12 for an additional report.30

Order Your Additional Reports

Requests for additional annual reports need to be made to each

credit bureau separately.

Equifax

Online:

http://www.equifax.com/CreditReportAssistance (Click

“Expand” next to “Get Your Credit Report” and click on “Get

Started” under “Other Ways to Obtain a Free or Discounted Credit

Report”)

Phone: 1-800-685-1111

Mail: Equifax Disclosure Department, P.O. Box 740241, Atlanta,

GA 30374

Experian

Online:

https://www.experian.com/reportaccess/ (Click on “Request My

Credit Report”) Phone: 1-888-EXPERIAN

TransUnion

Online:

https://disclosure.transunion.com/dc/disclosure/disclosure.jsp

Phone: 1-800-888-4213

Mail: Send this form

(https://disclosure.transunion.com/pdf/DisclosureRequest.pdf) to

TransUnion LLC, P.O. Box 1000, Chester, PA 19022

Innovis

Innovis doesn’t have an online way to order credit reports

Phone: 1-800-540-2505

Mail: Send this form (https://www.innovis.com/pdf/InnovisCreditReportRequest.pdf)

Walk in: 875 Greentree Road, 8 Parkway Center, Pittsburgh, PA

15220

There are other non-official sites that offer free reports. Some

sites offer free credit scores too. Beware of sites that promise

free reports and scores but may use trial offer gimmicks to urge

you to switch to paid credit monitoring or other services.

There are some sites that offer no strings attached, free

services - just expect to see ads and also know that the credit

scores are these sites’ own estimates based on your credit

reports and not a FICO score as used by most creditors (some

FICO scores may be slightly customized by different bureaus or

lenders). Here are a few of these sites:

-

Credit.com offers a free credit

score based on your Experian report.

-

Credit Karma (creditkarma.com)

provides free weekly access to your Equifax and TransUnion

credit reports and updated credit scores based on those credit

reports. They also provide free daily credit monitoring of your

TransUnion credit report.

-

Credit Sesame (creditsesame.com)

offers a free credit score based on your Experian report and

free credit monitoring of your Experian report. They will also

send you daily alerts via text, email, or through their app, of

any changes to your Experian credit report.

-

FreeCreditReport.com offers a free

Experian credit report.

Free Credit Scores From Your Credit Card Company:

More and more credit card companies are joining

a FICO program that is being encouraged by the U.S. Consumer

Financial Protection Bureau (CFPB). Look for information on your

monthly statement. If you cannot find a free credit score

disclosure, ask your credit card company to start providing one.

Opting out of pre-approved (pre-screened) credit & insurance

offers is your legal right and is recommended for all consumers.

Credit and insurance companies buy “prescreened” lists from the

credit bureaus to make pre-approved offers to prospective

customers. While such offers provide consumers with information

about possible credit options, identity thieves may steal these

pre-approved offers and apply for them with your personal

information.

Optoutprescreen.com is the official website

sponsored by the four national credit bureaus where by law you

can opt out of receiving these offers for five years or

permanently. You can also opt back in any time using this

website. Alternatively, you can call the opt-out number toll-

free 1-888-5-OPT-OUT (1-888-567-8688). Note that while opting

out dramatically slows the flow

of credit card offers, it doesn’t stop it. Any company you have

a business relationship with can still make offers of its own

card or its partners’ cards.

Whether your personal information has been stolen or not,

your best protection against new account identity theft is the

security freeze (also known as the credit freeze).

Credit monitoring only lets you know after someone has opened a

new account in your name. A security freeze, on the other hand,

prevents most new accounts from being opened in the first place.

The best course of action for most consumers is to have their

credit reports at each of the three major national credit

bureaus frozen until they want to apply for credit, at which

time they can easily unfreeze or “thaw” their reports.

If you chose the security freeze, it is still advisable to

request and monitor your free annual credit reports, available

under federal law with each of the three major credit bureaus.

It is also recommended that you consider opting out of

pre-approved credit and insurance offers.

-

Do not disclose your

full nine-digit Social Security number unless absolutely

necessary, and never use it as an identifier or password.

Question those who ask for it.

-

Avoid paper billing by

requesting secure electronic statements instead. If you

require hard copies, you can print and store them safely

without risking mail theft.

-

Lock your mailbox if

it is lockable.

-

Shred documents

containing personal information (name, account numbers, Social

Security number, birth date) before throwing them away.

-

Configure your

computer and/or smartphone to require a password for use, and

set another password for sensitive files. Use unique passwords

that include a combination of letters, numbers, and symbols.

Do not use your birth date, a close relative's birth date, or

a combination of letters and numbers on Splashdata's annual

list of the most stolen passwords (https://www.teamsid.com/worst-passwords-of-2012).

Avoid “security questions” such as “What is your favorite

food” with answers such as “Pizza.”

-

Avoid using the same

password for different accounts, and change your passwords

once or twice per year.

-

Install and update

antivirus, anti-malware, and security programs on all

computers, tablets, and smartphones.

-

Don’t disclose

information commonly used to verify your identity on social

networking sites, such as date of birth, city of birth,

mother’s maiden name, name of high school, etc. If you do,

don't use that information to verify your identity.

-

Avoid using credit or

debit cards or conducting online banking transactions or

making purchases, paying bills, or sending sensitive

information over unsecured WiFi networks (e.g., any network

without a password log-in, such as on trains, at airports,

coffee shops, or hotels).

-

Disable Bluetooth

connections on devices when not in use.

-

Watch out for

“phishing” and other “social engineering” scams. Phishing is

when identity thieves request personal information by

pretending to be a legitimate entity, such as a bank or the

IRS. Ignore unsolicited requests for personal information by

email or over the phone, and only contact entities by means

you know to be authentic. Do not contact an entity by clicking

a link sent as part of an email requesting personal

information, because phishers often link to authentic-looking,

fake webpages. You can also call the phone number on the back

of a card previously issued to you, or call the phone number

on an old statement from that issuer.

-

Fight “skimmers.” Do

not give your debit card to a restaurant server or anyone who

could have a hand-held skimming device out of sight. When

using an ATM, look for suspicious cameras and holes, and touch

to confirm that extra parts (loose or slightly different

colors) have not been installed over the card reader. Always

cover your hand while hand typing a PIN, and avoid using ATMs

in secluded locations.

-

When accessing

financial information on your smartphone, only use apps

authorized by your bank or published by reputable app makers.

Apps that show thousands of downloads are probably safe. Do

not access apps on public open WiFi.

-

Place security, or

credit freezes, on your credit report. Guarantee peace of mind

against new account identity theft by freezing your credit

reports, then thawing them only when you are in the credit

markets. A creditor will deny credit to an imposter who

applies for credit using the name and Social Security Number

of a consumer who has placed a freeze.

-

Check your monthly

statements for unauthorized charges. Be suspicious of phone

calls about surprise debts.

-

Sign up to receive

email and/or text notifications of account activity and

changes to account information.

-

Instead of paying for

over-priced subscription credit monitoring, use your free

annual credit reports by law as your own credit monitoring

service. Every 12 months, federal law gives you the right to

receive one free credit report from each of the three main

consumer reporting agencies, Equifax, Experian and TransUnion.

Instead of requesting three at the same time, request one

credit report from one of the bureaus every four months.

Verify that the information is correct, and an account has not

been opened without your knowledge. Free credit reports are

available online at AnnualCreditReport.com or by

calling 1-877-322-8228. Seven states – Colorado, Georgia,

Maine, Maryland, Massachusetts, New Jersey and Vermont also

provide an additional free report by state law, available by

contacting each bureau directly.

1 By law, 49

states and the District of Columbia require the availability of

a security freeze. In 2007, the three major credit bureaus

started offering the security freeze voluntarily to consumers in

Michigan, the one state that doesn’t have a security freeze law.

See Consumers Union, Consumers Union’s Guide to Security

Freeze Protection, 5 February 2014.

2 North Carolina Department of Justice,

Lifting a Security Freeze, accessed at

www.ncdoj.gov/getdoc, 27

October 2015. See also

Experian, How Long it Takes to Thaw a Frozen Credit Report,

accessed at www.experian.com/blogs, 27 October 2015.

3 Privacy Rights Clearing House,

Chronology of Data Breaches/Security Breaches 2005 – Present,

accessed at www.privacyrights.org/data-breach,

27 October 2015. The Identity Theft Resource Center has their

own numbers too. According to them, from 2005 – September 22nd, 2015, there have been 5,593 breaches and

828,937,722 breached records. See Identity Theft Resource

Center, Data Breaches, accessed at

www.idtheftcenter.org/id-theft/data-breaches.html, 27

October 2015.

4 For many of the breaches listed with the

Privacy Rights Clearinghouse, the number of breached records

is

unknown. Additionally, their list does not include all breaches.

They include every reported breach with more than nine affected

individuals. They include every reported breach affecting nine

or fewer individuals if there is a compelling reason to alert

consumers. Breaches that were not reported to consumers or a

government agency are not included. See Privacy Rights

Clearinghouse, Chronology of Data Breaches: FAQ, accessed

at

www.privacyrights.org/data-breach-FAQ, 27 October 2015.

5 USA Today, “Cyber Breach Hits 10

Million Excellus Healthcare Customers,” USA Today, 10

September

2015.

6 Robert Hackett, “Experian Data Breach

Affects 15 Million People Including T-Mobile Customers,”

Fortune, 1 October 2015.

7 John D. McKinnon and Laura Saunders,

“IRS Says Cyberattacks More Extensive Than Previously Reported,”

The Wall Street Journal, 17 August 2015.

8 Amrita Jayakumar, “Michaels Says 3

Million Customers Hit by Data Breach,” The Washington Post,

19 April 2014

9 United States Office of Personnel

Management, Cybersecurity Resource Center Frequently Asked

Questions, accessed at

www.opm.gov/cybersecurity/faqs, 27 October

2015.

10 Clare O’Connor, “Surprise! Target

Data Breach Could Include Your Info from Purchases Made a Decade

Ago,” Forbes, 16 January 2014. See also Ross Kerber, Phil

Wahba, and Jim Finkle, “Target Apologizes for

Data Breach, Retailers Embrace Security Upgrade,” Reuters,

13 January 2014.

11

T-Mobile also offered its customers and

applicants an alternative to Experian’s ProtectMyID credit

monitoring service. It is a service through CSID. Enrollment can

be done at www.protectmyid.com/alt. 12U.S.

PIRG joined other organizations in a letter to the CFPB and

other regulators asking a number of questions about this breach.

See U.S. PIRG, PIRGs, Others Ask CFPB & FTC to Investigate

Experian/T- Mobile Data Breach (press release), 8 October

2015.

13 Jonnelle Marte and Lisa Rein, “IRS

Enhances Efforts to Combat Identity Fraud, Claiming Upcoming Tax

Season Will Be ‘More Secure,’” The Washington Post, 20

October 2015.

14 Jeff Blyskal, Consumer Reports,

Expect Less and Pay More with Target’s Credit Monitoring, 6

February 2014

15 Susan Grant, Director of Consumer

Protection and Privacy, Consumer Federation, personal

communication, 17 September 2015

16 According to the FTC, “Some companies offer

services to help you rebuild your identity after a theft.

Typically, you give these services a limited power of attorney,

which allows them to act on your behalf

when dealing with consumer reporting companies, creditors, or

other information sources.” See Federal Trade Commission,

Identity Theft Protection Services, accessed at

www.consumer.ftc.gov/articles/0235-

identity-theft-protection-services, 27 October 2015.

17 The ability to place free fraud alerts on

your reports comes from the Fair and Accurate Credit

Transactions Act of 2003 (FACTA). This act amended the Fair

Credit Reporting Act (FCRA), in order “to prevent identity

theft, improve resolution of consumer disputes, improve the

accuracy of consumer records, make improvements in the use of,

and consumer access to, credit information, and for other

purposes.” See 108th

Congress, Fair and Accurate Credit Transactions Act of

2003, 4 December 2003.

18 As an example, Target acknowledged the rise

of phishing scams in the wake of its 2013 holiday season

data breach. See Jeff Blyskal, Consumer Reports, Expect Less

and Pay More with Target’s Credit Monitoring, 6 February

2014.

19 Federal Bureau of Investigation,

Spear Phishers Angling to Steal Your Financial Info, 1 April

2009.

20 John Markoff, “Larger Prey Are

Targets of Phishing,” The New York Times, 16 April 2008.

21 Federal Trade Commission, Credit

Freeze FAQs, March 2014.

22 Equifax, Security Freeze Fees and

Requirements, 7 October 2015.

23 Ibid.

24 U.S. Public Interest Research Group

and Consumers Union, The Clean Credit and Identity Theft

Protection Act: Model State Laws, November 2005.

25 The ability to request a free annual credit

report from each of the three main credit bureau and to place

free fraud alerts on your reports comes from the Fair and

Accurate Credit Transactions Act of 2003 (FACTA). This act

amended the Fair Credit Reporting Act (FCRA), in order “to

prevent identity theft,

improve resolution of consumer disputes, improve the accuracy of

consumer records, make improvements in the use of, and consumer

access to, credit information, and for other purposes.” See 108th Congress, Fair and Accurate Credit

Transactions Act of 2003, 4 December 2003.

26 For additional information about

alternatives to paid monitoring, Privacy Rights Clearinghouse

has a

fact sheet about monitoring services. See Privacy Rights

Clearinghouse, Identity Theft Monitoring Services,

October 2015, available at

www.privacyrights.org/fs/fs33-CreditMonitoring.htm

27 Innovis, Credit Report Fees,

accessed at

www.innovis.com/personal/creditReportFees, 27 October

2015.

28 Federal Trade Commission, What To

Do Right Away, accessed at Identitytheft.gov, 27 October

2015. 29 Innovis, Credit Report Fees,

accessed at

www.innovis.com/personal/creditReportFees, 27 October 2015.

30 Consumer Financial Protection Bureau,

How Much Does it Cost to Get a Copy of

My Credit Report if

I’ve Already Received All of My Free Credit Reports?, 6 January 2015. Also, state laws change, so

consumers can check with their state or local consumer

protection agencies about their rights to free or reduced cost

credit reports.

|

|